Research reveals Homer Simpson has endured $143m worth of Injuries

Research reveals Homer Simpson has endured $141m worth of injuries, doh!

The Simpson’s are the dysfunctional American family that has been entertaining us for over 30 years. Their eventful day-to-day life in Springfield has viewers laughing with familiarity at the misfortunes of one particular main character, Homer Simpson. Although fictional, his ability to continuously injure himself had us wondering what the financial repercussions would be for him in the real world.

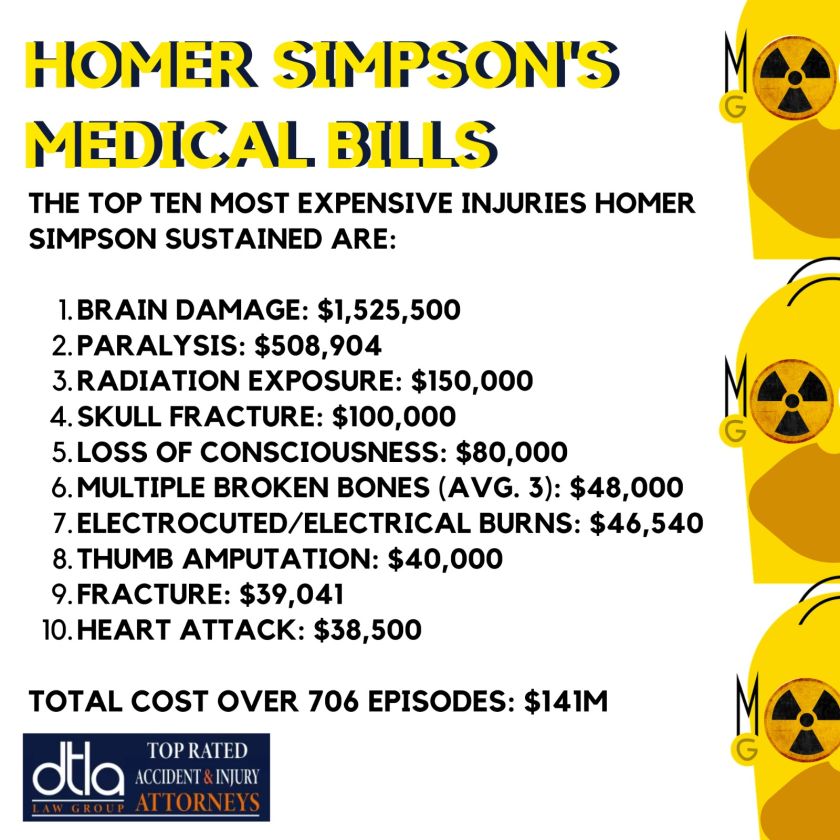

Arguably one of the most influential characters in the history of television, Homer Simpson is a working-class family man known and adored for his laid-back parenting and comical behaviour. His stunts, bad luck, and general accident-prone nature have since racked up an estimated $141 million in medical bills over the show’s 706 episodes, which is 443 times more than the average American*, doh!

To reveal how much Homer Simpson would have spent on hospital bills, we studied a sample of 50 memorable incidents from the 31-season-long TV show, with the purpose of shedding light on the dangers and potential cost of not having life insurance.

The top five most expensive injuries Homer Simpson sustained are:

- Brain damage: $1,525,500

- Paralysis: $508,904

- Radiation exposure: $150,000

- Skull Fracture: $100,000

- Loss of Consciousness: $80,000

In terms of the most common injury sustained, Homer Simpson’s clumsy nature has seen him fall over, down the stairs and off roofs, breaking numerous bones on ten separate occasions, costing him an estimated $48,000 each time. The results of these falls have often come with a suspected concussion, costing an estimated $800 for each of the eight incidents.

To gauge the cost of each individual injury, our attorneys tracked the average cost for each suspected injury. The predicted cost of Homer Simpson’s medical bills should showcase the importance of health insurance, and how it can prevent future financial burden.

Our team of attorney’s looked at 50 well-documented accidents, across multiple series of The Simpsons – these injuries span across; multiple broken bones, head injuries, animal attacks and food poisoning. The estimated total cost of injuries is $10,107,798, based on 50 episodes of the TV Show. If this were an average medical bill, the total could equate to a staggering $141M over the course of the 706 episodes.

Prices are based on if Homer Simpson was a real person and medically uninsured. If a real-life accident-prone person with added health conditions were to get insurance, Under the Affordable Care Act, health insurance companies can’t refuse coverage or charge more because of serious pre-existing conditions. However, being accident-prone and sustaining lasting injuries can impact the ability to secure life insurance.**

Health can have a big impact on how much people pay in monthly premiums as it’s one of the things an insurer will use to assess how much of a risk it would be to insure someone. Although a person’s health shouldn’t stop someone from getting a policy, it could mean that they end up paying more for life insurance than someone who’s in good health. The average American spends $316,600* on healthcare in a lifetime, whilst Homer Simpson has spent 443 times more than that already at the age of 39.

Farid Yaghoubtil, Senior Trial Attorney at Downtown L.A, says:

“We are dedicated to protecting and serving the rights of individuals who have been injured in an accident resulting from the negligence or wrongdoing of others. We carried out this research to hopefully share the importance of having adequate medical insurance as the costs for injuries can be extremely high.

“Whilst Homer Simpson is a fictional character, his injuries are very real, and examples of incidents that many people are entitled to compensation for. We hope this medical bill rap sheet encourages anyone who is considering it, to get health insurance and avoid paying the price.”

*https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1361028/

**https://www.choozi.com/life-insurance/getting-life-insurance-after-a-serious-accident/

Over $1 BILLION Recovered

for Our Clients

YOU Deserve the Best

Free Case Review 24/7

You Don’t Pay unless we win

Call (855) 339-8879

"*" indicates required fields

Featured Lawyers